How To Crash the Economy, Big Government Style

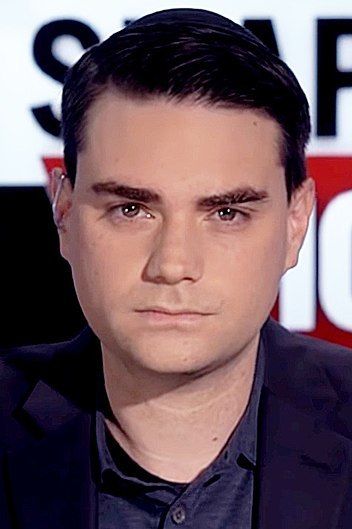

By Ben Shapiro

We are in a looming financial crisis, even if we don't want to see it.

Silicon Valley Bank (SVB) was, according to Moody's, worthy of an investment-grade rating as of March 8, 2023. S&P Global Ratings similarly held a high opinion of SVB. Two days later, SVB was shut down; immediately, Moody's dropped SVB into junk territory. So did S&P Global Ratings. Within days, Signature Bank -- with Barney Frank, co-sponsor of the famed and much-ballyhooed Dodd-Frank Act, on the board -- went belly up.

The Biden administration, touting its own heroism, immediately stepped in to fill the gap. Concerned that unsecured depositors would lose billions in cash, Team Biden announced that all unsecured depositors would get their money back; the Federal Reserve launched a Bank Term Funding Program, to create additional reserves for the banks. Then President Joe Biden himself claimed that he had stabilized the banking system.

He hasn't.

To understand just why throwing money at the problem with the banks won't solve the underlying issue, we need to understand just why SVB failed in the first place. It failed thanks to three specific factors: from 2020 to 2022, the federal government injected more liquidity into the American economy than at any time in history, bar none; SVB, trusting that the liquidity would keep on coming, socked away a large amount of that liquidity into bonds, which bore a low interest rate; the federal government, having now created an inflationary wildfire, had to count on the Federal Reserve to cut inflation by raising interest rates. Those increased interest rates made SVB's bond holdings lower; when depositors, hampered by the lack of easy money, started to withdraw their cash, SVB had to liquidate the bonds at a loss, essentially bankrupting them.

So, what happened? Simply put, the federal government created a carousel of easy cash; investors thought the carousel would never stop; it stopped. Now, the federal government blames capitalism -- and in the process, claims that by injecting more liquidity into the system, it will prevent capitalism from melting down the banks. But instead, the federal government has created two new problems: first, the Federal Reserve has now given itself the unenviable task of simultaneously quashing inflation (which requires raising interest rates) and shoring up the banks (which requires lowering them and/or injecting more liquidity); second, the federal government has created a new and massive moral hazard, whereby bank managers know that if they promise outsized returns to their depositors, they can gain their business -- and worst case scenario, the government will bail out the depositors anyway.

Now the experts tell us that the Biden team will achieve a soft landing -- that they'll somehow square the circle, lowering inflation while preventing bank assets from depreciating, incentivizing financial responsibility while simultaneously backstopping bad decision-making, promoting fiscal responsibility while proposing $7 trillion budgets. No one has this kind of power, least of all the team that's brought America four-decade-high inflation, the highest interest rates since before the 2007-2008 financial crash and an ever-soaring national debt.

No, the crisis will arrive. If it feels like the federal government can fly, that's just because it always feels that way when you jump out of a tenth-story window and you're nine stories down. Joe Biden and the economy are not immune to the forces of financial gravity.

We are in a looming financial crisis, even if we don't want to see it.

Silicon Valley Bank (SVB) was, according to Moody's, worthy of an investment-grade rating as of March 8, 2023. S&P Global Ratings similarly held a high opinion of SVB. Two days later, SVB was shut down; immediately, Moody's dropped SVB into junk territory. So did S&P Global Ratings. Within days, Signature Bank -- with Barney Frank, co-sponsor of the famed and much-ballyhooed Dodd-Frank Act, on the board -- went belly up.

The Biden administration, touting its own heroism, immediately stepped in to fill the gap. Concerned that unsecured depositors would lose billions in cash, Team Biden announced that all unsecured depositors would get their money back; the Federal Reserve launched a Bank Term Funding Program, to create additional reserves for the banks. Then President Joe Biden himself claimed that he had stabilized the banking system.

He hasn't.

To understand just why throwing money at the problem with the banks won't solve the underlying issue, we need to understand just why SVB failed in the first place. It failed thanks to three specific factors: from 2020 to 2022, the federal government injected more liquidity into the American economy than at any time in history, bar none; SVB, trusting that the liquidity would keep on coming, socked away a large amount of that liquidity into bonds, which bore a low interest rate; the federal government, having now created an inflationary wildfire, had to count on the Federal Reserve to cut inflation by raising interest rates. Those increased interest rates made SVB's bond holdings lower; when depositors, hampered by the lack of easy money, started to withdraw their cash, SVB had to liquidate the bonds at a loss, essentially bankrupting them.

So, what happened? Simply put, the federal government created a carousel of easy cash; investors thought the carousel would never stop; it stopped. Now, the federal government blames capitalism -- and in the process, claims that by injecting more liquidity into the system, it will prevent capitalism from melting down the banks. But instead, the federal government has created two new problems: first, the Federal Reserve has now given itself the unenviable task of simultaneously quashing inflation (which requires raising interest rates) and shoring up the banks (which requires lowering them and/or injecting more liquidity); second, the federal government has created a new and massive moral hazard, whereby bank managers know that if they promise outsized returns to their depositors, they can gain their business -- and worst case scenario, the government will bail out the depositors anyway.

Now the experts tell us that the Biden team will achieve a soft landing -- that they'll somehow square the circle, lowering inflation while preventing bank assets from depreciating, incentivizing financial responsibility while simultaneously backstopping bad decision-making, promoting fiscal responsibility while proposing $7 trillion budgets. No one has this kind of power, least of all the team that's brought America four-decade-high inflation, the highest interest rates since before the 2007-2008 financial crash and an ever-soaring national debt.

No, the crisis will arrive. If it feels like the federal government can fly, that's just because it always feels that way when you jump out of a tenth-story window and you're nine stories down. Joe Biden and the economy are not immune to the forces of financial gravity.

Ben Shapiro, 38, is a graduate of UCLA and Harvard Law School, host of "The Ben Shapiro Show," and co-founder of Daily Wire+. He is a three-time New York Times bestselling author; his latest book is The Authoritarian Moment: How The Left Weaponized America's Institutions Against Dissent. To find out more about Ben Shapiro and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2023 CREATORS.COM.

COPYRIGHT 2023 CREATORS.COM.

Recent

The Heart of the Matter Is the Matter of the Heart

February 14th, 2026

People of Color can also steal…Duh?

February 14th, 2026

The Monroe Doctrine Isn’t Outdated — It’s Vital for American Security

January 5th, 2026

Defining Racism “UP”

January 4th, 2026

The Voting Rights Act Should Protect Voting—Not Perpetuate Fear

January 4th, 2026

Archive

2026

2025

February

March

July

September

October

November

2024

January

Cartoon 01/01/24Cartoon 01/02/24Claudine Gay Betrayed the American Values of My Black Elders to Exploit White GuiltCartoon 01/03/24Cartoon 01/05/24Cartoon 01/06/24Cartoon 01/07/24Cartoon 01/08/24We need a David, not a SaulCartoon 01/13/24Cartoon 01/09/24Cartoon 01/10/24Cartoon 01/11/24Cartoon 01/14/24Cartoon 01/12/24What Happens to a King Deferred? A ReduxCartoon 01/15/24Cartoon 01/16/24The Good Guys with Guns Part 1Cartoon 01/17/24America Works. DEI Doesn’t.Cartoon 01/18/24Cartoon 01/23/24Good Guys with Guns Part 2Cartoon 01/19/24Cartoon 01/21/24Cartoon 01/22/24Cartoon 01/24/24Cartoon 01/26/24Cartoon 01/25/24Cartoon 01/27/24

February

Cartoon 02/04/24Cartoon 02/03/24Cartoon 02/02/24Cartoon 02/01/24Cartoon 01/31/24Cartoon 01/28/24Cartoon 01/29/24We’ve Been Gay(ed) Part 1Cartoon 02/05/24Cartoon 02/06/24Cartoon 02/07/24Cartoon 02/08/24Cartoon 02/13/24Cartoon 02/12/24Cartoon 02/09/24Cartoon 02/11/24Cartoon 02/10/24Cartoon 02/19/24'Black America at Crossroads’ of Culture Wars as Presidential Election LoomsWe’ve Been Gay(ed) Part 2Cartoon 02/18/24Cartoon 02/17/24Cartoon 02/16/24Cartoon 02/15/24Cartoon 02/14/24Cartoon 02/22/24Cartoon 02/21/24Cartoon 02/20/24America Needs a “Black Wives Matter” Movement To Rebuild the Black FamilyCartoon 02/23/24Cartoon 02/24/24Cartoon 02/25/24Cartoon 02/26/24Cartoon 02/27/24

No Comments